After gaining over 13 years of global investment banking experience with stints at Merrill Lynch and Renaissance Capital, Patrick Mweheire returned to his native Uganda in 2012 to join Stanbic Bank. In January 2015, he was appointed CEO, becoming the first Ugandan to head the bank since Standard Bank became majority shareholder in 2001.

The Report Company: What is Stanbic Bank’s position in Uganda?

Patrick Mweheire: Stanbic is the largest bank in the country measured by assets and by branch network. When Standard Bank Group (SBG) acquired Uganda Commercial Bank, it inherited a really large footprint. We have a network of around a hundred branches dotted across the country, so we’re a key stakeholder in financial services in the country. Historically, we have been the bank for the people and for the government, and we have always had the largest market share in terms of retail customers.

I believe that the bank is very well-positioned particularly because of our parent, SBG, which owns 80 percent of the bank. Twenty percent is floated and is owned by Ugandans and a few other institutions. Standard Bank is going through its own transformation, with a renewed focus on its competitive advantage, which is its footprint across 20 African countries. The focus is Africa, and it’s a very powerful statement that the largest bank in Africa is focusing on Africa.

Last year, over 30 percent of Standard Bank’s earnings were from Africa. Five years ago, that number was a rounding error. It is predicted that by 2017, 50 percent of the group’s revenue will be out of the African continent, so that is a dramatic shift. We’re doing much larger transactions, and that balance sheet scalability that is coming through to deliver for the continent and for Uganda is very exciting.

“I have taken a different approach from my peers in terms of fighting this inevitable mobile money revolution. I don’t buy the notion that mobile money is stealing from banks or that it’s a zero-sum game.”Post This

TRC: In 2013, Stanbic Bank Uganda’s net profit fell by 22 percent versus 2012. Were these losses reversed in 2014?

PM: In 2014, we had a very strong year. We grew 33 percent year on year so we made up for 2013. We made a profit after tax (PAT) of UGX 135 billion; who said elephants can’t dance? We’re the largest player in the market, so to grow by that amount is incredible. It means that we got some things right, so we are very excited about where we are and where we are positioned.

There are obviously some challenges on the retail side, because we have to figure out what we want to be. I think the value proposition along the way has got lost so I’m spending some time trying to understand the segments.

TRC: What are your focuses for this year?

PM: Leveraging mobile money is something we have talked about. This is a very powerful platform to reach the unbanked. There are some real peculiarities in retail banking in Uganda. A significant amount of the traffic to our branch network comes from customers coming to check their account balance. So just by getting people to migrate to ATMs and self-serve kiosks, we will be able to reduce our cost to serve, because running a branch is very expensive.

Service is an area that I’m spending a lot of time on. When you’re the biggest player in the market, you become complacent. We were ranked 10th out of 25 banks recently in terms of service, whereas we should be in the top three. I’ve recently created a role for a head of service delivery who reports to me and the mandate is to deliver service across the network.

We are also focusing on SMEs. I looked into the numbers and almost 80 percent of our SME revenue comes from 20 percent of our clients, so we’re carrying a lot of non-revenue-creating clients. We need to look at what makes them bankable and how the relationship works. We need to get to give these people more appropriate products and services.

TRC: What new products are you working on?

PM: One we have launched recently is ‘account to wallet’, where you can go online and with two clicks you can move money directly from your Stanbic bank account to your mobile phone. Another, which we will launch in Q3, is a savings and loan product. A lot of people carry float on their mobile money account, so people can put this away and get some interest.

A third product is international remittances. Uganda receives about $1 billion every year in remittances from the diaspora, with average values of $100. These people are sensitive to fees, so we’re launching a product which will run over the Visa and MasterCard system where you go online, put in your card and send your money directly to a mobile. It removes a lot of steps and fees.

“Uganda is important and we are consistently a top quartile contributor within the Group’s Africa operations”Post This

TRC: What is your view of the growth of mobile money in Africa?

PM: I have taken a different approach from my peers in terms of fighting this inevitable mobile money revolution. We have to embrace the mobile money revolution. We are partners with MTN and actually hold the mobile money escrow account. Additionally, mobile money is regulated by the Bank of Uganda through us as a proxy. What this means is that we are a key stakeholder in the communications with the central bank. It gives us a seat at the table and allows us to be at the cutting edge in terms of developing and investing alongside MTN. I don’t buy the notion that mobile money is stealing from banks or that it’s a zero-sum game. I don’t think it is. If it was, we would have more than five million bank accounts. Clearly they have something that has managed to reach an additional 15 million people that we couldn’t. My view is that we can either sit here and cry about it, or we can try and figure out how to add value. I’ve taken the second approach. I think we’re going to see some really mindboggling changes in how people use their mobile phone.

TRC: How important is Uganda to the group?

PM: Uganda is important and we are consistently a top quartile contributor within the Group’s Africa operations. What is also important is that we are a number one player in Uganda with a PAT market share of 25 percent.

TRC: Where do you see opportunities for growth?

PM: I’m aiming for at least 20 percent growth for the bank this year. It’s ambitious, but I think there are some things we can do to get there. I really believe in this oil and gas story, and the fact that the refinery now has a selected winner has become a catalyst. We believe that production licenses for Total and Tullow will be granted very soon and we will start to see more activity in the sector.

TRC: To what extent has your international investment banking background informed your approach to leading the bank?

PM: Investment banking provides you with a good background and solid training. It gives you a great analytical mind and really stretches you, so it did give me a very good foundation to come back here. However, a lot of people were convinced that this market would never develop into a sizeable investment banking opportunity. We’ve proved them wrong. We led the IPO of Umeme, whose stock price is up 90 percent since we took it public, and we did the largest secondary block trade in Africa. We arranged the largest single private financing ever in Uganda, for $200 million which was syndicated out with Standard Chartered, so there’s some really exciting activity that is happening.

I’m a big believer that you can’t look at these markets in isolation and say, this is the size of the pie. The pie can be exponentially increased if you have people on the ground digging around, putting the resources together and speaking to clients. My investment banking experience has not been completely wasted and I’m happy about that.

On the commercial side, the business is quite complex. We’ve got a very solid trading business, and our trading desks are almost a quarter of our profits. There’s some innovative activity coming through and it’s been quite interesting.

TRC: What is your take on Uganda as a new frontier for investment?

PM: I think Uganda is one of the most exciting stories in Africa. It’s grown about seven percent in the last decade and remains in the top 25 growing countries in the world. It is expected to grow at a compounded annual growth rate of seven percent over the next 10 years. It’s the most liberalized country in the region, more so than Kenya or Tanzania. It has a free floating exchange rate, 100 percent foreign ownership is allowed and we have the demographic dividend because Uganda has the fastest-growing population in Africa, and the third fastest in the world.

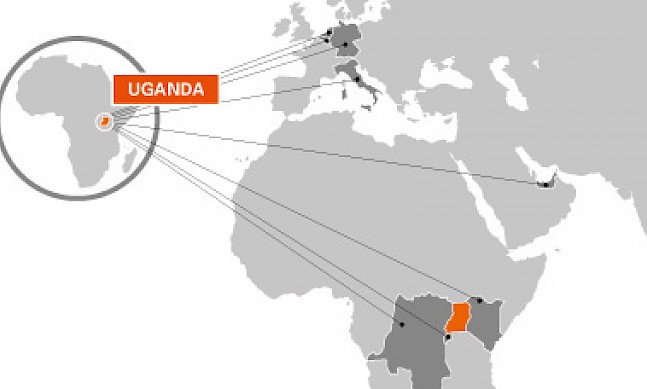

Uganda is a landlocked country but we are very uniquely positioned. We have five neighbors: Kenya, Tanzania, South Sudan, DRC and Rwanda, and Uganda acts as a major link for trading in the region. We’ve been a very stable country politically and we have been the largest source of FDI in the region.