Founded in the 1990s following the liberalization of the coffee sector, Kyagalanyi is a member of ED&F MAN Volcafe Coffee Division and has grown to be one of Uganda’s largest companies in coffee procurement, processing and marketing. David Barry, the firm’s chairman, spoke to The Report Company about what makes Ugandan coffee so special.

The Report Company: What coffee is available in Uganda?

David Barry: Ugandan coffee production is about 80 percent Robusta and 20 percent Arabica. It’s traditionally known for its Robusta coffee, but the Arabica segment is becoming increasingly important as we are becoming much better at producing very good Arabicas.

TRC: Few people know that Uganda is the birthplace of Robusta coffee. Why do you think this is so?

DB: Coffee has only just become, let’s say in the last few years, quite fashionable, with the advent of the gourmet coffees and the coffee shop explosion all over the world. It’s a relatively new development so people’s interest in coffee is quite a new development and Robusta coffee has always been known as the poor cousin of Arabica coffee. I don’t think that is strictly true; there are some very nice Robustas. If you go to Italy, for example, you receive beautifully-served coffee which is often pure Robusta, and it tastes extremely good.

“There is an increasingly more enlightened government. The president and the government of Uganda have done a very good job.”Tweet This

TRC: What are your company’s primary activities?

DB: We are primarily procuring coffee, processing coffee and exporting coffee and we sell a little locally. The consumption of coffee internally in Uganda is at a very low base. It is, however, growing very rapidly and we now have 30 or 40 good coffee shops in Kampala, whereas a decade ago, there were only a couple. The coffee consuming culture is starting in Uganda, but the country is more traditionally a tea-drinking country.

TRC: How much coffee does Uganda produce?

DB: Uganda’s production in the early 1960s was about 2.7 million bags. Productivity growth has been rather slow over the years, and annual production has averaged around 2.7 - 2.8 million bags over the last 40 years. We are now beginning to see production improve with better agricultural practices, better yields for the coffee, better prices for the coffee and more interesting coffees, so in the last couple of years we have seen exports at the 3.5 million bag mark. If you compare this with the giants of the industry which are Brazil with 50 or 60 million bags, Vietnam with 30 million bags, and Colombia which is at 12 million bags, we rank number ten in the world in terms of the volumes we export. In Africa, we are the leading exporter of coffee. Ethiopia, which is the birthplace of Arabica, produces more but has a very large internal consumption.

TRC: How does Ugandan coffee compare to other coffees around the world?

DB: The Robustas we produce are of excellent quality and along with India are considered primary or top Robustas. As far as the Arabicas are concerned, our top washed Arabicas are really good and taste generally very clean with some nice body and flavor.

“Uganda is beginning to become recognized for some of the better Arabica coffees. It is a long process to make them stable and regular and accepted by the market but it is happening in a most positive manner.”Tweet This

TRC: What are you doing to boost production?

DB: We have invested in primary processing in key producing areas. We do a lot of work with farmers and farmer groups. Most of the coffee produced in Uganda is in through the hands of smallholders each of who produce relatively small amounts of coffee – certainly in comparison with farmers in the larger producer countries. There are around one million households producing coffee and the process of disseminating good agricultural practices is therefore quite a cumbersome exercise.

We do work as closely as we can with farmers to help lift the yields, quality and practices. The average yield in Uganda is about 10 bags per hectare; if you go to some of the areas in Brazil they are able to produce 60 or 70 bags. In Vietnam the yields can be as high as 40 or 50 bags. Uganda’s yields are low but this does mean that small holders have a huge opportunity to increase their income by tweaking productivity levels. A modest increase to, say, 12 bags would result in a 20 percent increase in output – good news for the smallholder which would also nudge Uganda towards a four million bags per annum export number, making us a more interesting origin for medium and large roasters.

There are also, as mentioned, positive developments within the domestic or internal consumption market. In some of the training we do, we actually bring smallholding farmers to taste coffee, and it’s amazing because it may be the first time that they’ve tasted a product that they’ve grown for several generations. They then understand why it’s better to pick ripe cherries, dry them properly; all these different but simple practices contribute greatly to improvement in the supply chain.

TRC: Do you envisage domestic consumption of coffee increasing?

DB: Domestic consumption is a very good thing for the coffee industry. As people develop a taste for coffee and income levels go up, people will start to appreciate it, start to drink their own coffee and have more pride in the coffee value chain and derive tremendous economic benefits from the value addition. Coffee roasters, distributors and coffee shops employ people.

TRC: Where do you export to?

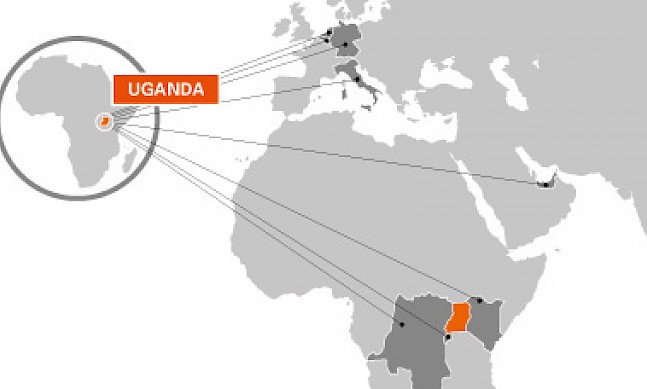

DB: We ship to about 30 countries. The major market for Ugandan coffee is the European Union, while Sudan is also a major destination for Ugandan Robusta coffee. We are seeing increasing sales to new or non-traditional consuming countries like China and Korea.

TRC: Where do you see Uganda’s niche in the coffee industry?

DB: Uganda is already recognized as key Robusta origin but is additionally being recognized for some of the better Arabica coffees. It’s a long process to make them stable and regular and accepted by the market but it is happening in a significant fashion. The coffee is still relatively well priced, so roasters who understand it are using Ugandan coffee, although they may not be advertising it in the final product. We have a very good range of coffees, from very low grade to very high grade, so in that respect it’s a very interesting origin with some real human endeavors driving it.

TRC: What has been your experience in Uganda as an investor?

DB: The economic environment is liberal and enabling. There are no exchange controls and there is a a positive and friendly attitude towards commerce. People often ask why people bring coffee from other countries to Uganda and the answer is because the free market system works very well. Farm gate prices are rich relative to final export prices. Price dissemination and competition are at elevated levels.

There is an increasingly more enlightened government. The president has done a very good job. Developing countries are in a different category to very mature economies and mature political systems. This is a new political system. People try and talk about President Mugabe and President Museveni in the same breath but they are not the same. One took a functioning country and made it less functional and the other took a broken, dysfunctional country and made it into something that works. The development and growth over the last 30 years in Uganda has been extraordinary. There has been huge improvement at all levels. It’s also one of the most secure countries in sub-Saharan Africa; you don’t feel threatened or unsafe.