Now in his third term as central bank governor, economist Emmanuel Tumusiime-Mutebile spoke to The Report Company about the overall shape of the Ugandan economy, and outlined its strengths and weaknesses.

The Report Company: How vulnerable is the economy of Uganda to external shocks?

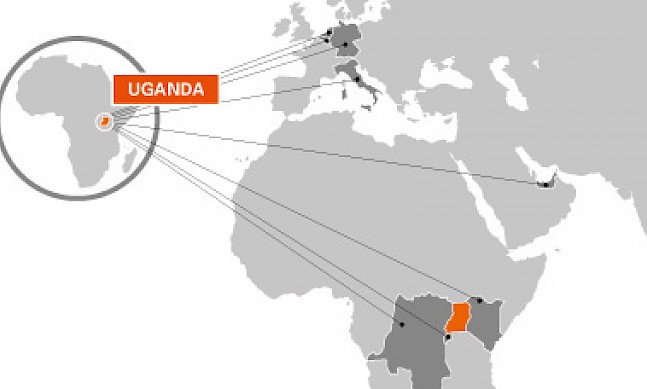

Emmanuel Tumusiime-Mutebile: An economy which is so well integrated into the global economy as that of Uganda, with open current and capital accounts of the balance of payments, unavoidably faces some risks from external shocks. However, these risks can be mitigated through a combination of diversification and prudent economic management.

Uganda has suffered a fall in exports to South Sudan, our largest single export market, because of the civil conflict in that country. However, because our exports are well diversified, both in terms of their composition and the markets in which they are sold, the overall impact of the problems in South Sudan on our earnings of foreign exchange from exports of goods and services is not very large.

Like all other emerging and frontier markets, Uganda can be affected by volatile capital flows. The diverging monetary policy strategies being pursued by central banks in the developed economies are causing strains in global financial markets, which in turn affect short term capital flows to frontier and emerging markets. However, more than three quarters of Uganda's capital account surplus is accounted for by foreign direct investment and borrowing from official sources, such as multilateral institutions, which are relatively stable sources of funding.

Consequently, although turbulence in global financial markets can have an impact on capital flows to Uganda, we will still be able to mobilize the capital needed to finance the balance of payments.

TRC: What role can Uganda’s banks play in driving development?

ETM: The most important role which banks and financial institutions can play to support development is in channeling credit to the business sector. Although there has been very strong growth in financial intermediation over the last decade, the Ugandan financial sector is still very shallow and dominated by commercial banks. I would like to see banks both allocating more credit to financially viable businesses and extending loans with longer maturities. Over the long term, we need to develop a more diversified financial sector which includes specialized financial institutions which can meet specific needs of the business sector. The pending liberalization of Uganda's pension sector will help to promote this diversification, by encouraging private sector pension providers to enter the market, and to mobilize long term savings which can be invested in securities issued by companies with good commercial prospects.

“Uganda offers good growth prospects, macroeconomic stability and a predictable, market-oriented economic policy environment.”Tweet This

TRC: Uganda has over 18 million registered mobile money customers with an average monthly value of the transactions of UGX 2.1 trillion. What is the impact of mobile money as a tool for financial inclusion in Uganda?

ETM: Mobile money has had a tremendous impact in extending financial inclusion for one important dimension of financial services; money transfers and payments. However, there are other dimensions of financial services, such as the provision of credit and insurance products, for which the delivery is much more difficult through mobile banking, as these services often require direct contact between customers and the staff of financial institutions. Consequently, if financial inclusion is to be extended to a broader range of financial services, it will be necessary for financial institutions to develop more efficient mechanisms for delivering their services; mechanisms which can reduce the transactions costs involved.

TRC: How would you appraise the progress of the East African Community’s monetary union, which is targeted for implementation by 2023?

ETM: The monetary union is the third step in the process of integrating the economies

of the five partner sates of the EAC. The EAC has already established a customs union, allowing free movement of goods within the EAC. We are currently in the process of implementing a common market, which will allow free movement of services and factors of production. The monetary union should cement the gains of the customs union and the common market by enabling citizens and firms in the EAC to trade with each other in a common currency. Regional integration of financial services, which the implementation of the common market will promote, should itself induce efficiency gains in the financial system, through strengthened competition in financial markets and by enabling financial institutions to realize economies of scale.

“Although turbulence in global financial markets can have an impact on capital flows to Uganda, we will still be able to mobilize the capital needed to finance the balance of payments.”Tweet This

TRC: What have been the greatest challenges you have faced during your time in this role and what statement would you like to give foreign investors about your country?

ETM: My greatest challenge as governor was the rapid rise in inflation which took place in 2011. This was caused by a combination of very high global food price inflation, the depreciation of the Ugandan exchange rate, which led to higher domestic prices for imports and very strong bank credit growth. We have now strengthened our monetary policy framework with the introduction, in mid-2011, of an inflation targeting framework. Because this is a forward-looking framework which involves adjusting interest rates on the basis of inflation forecasts, it provides the Bank of Uganda with a much more effective policy tool to dampen inflationary pressures before inflation increases too rapidly above our medium term target of 5 percent. Hence I am confident that we will not see a repeat of what happened in 2011.

The message that I would like to give potential investors is that Uganda offers good growth prospects, macroeconomic stability and a predictable, market-oriented economic policy environment.