Rakesh Jha’s international banking career began in his native India, and then took him to Dubai, Mauritius and Seychelles before he took on his current role as CEO of Barclays Bank Uganda in September 2014. He spoke to The Report Company about what Uganda means to Barclays, and what he aims to do during his time in the role.

The Report Company: What is the focus of Barclays in Uganda?

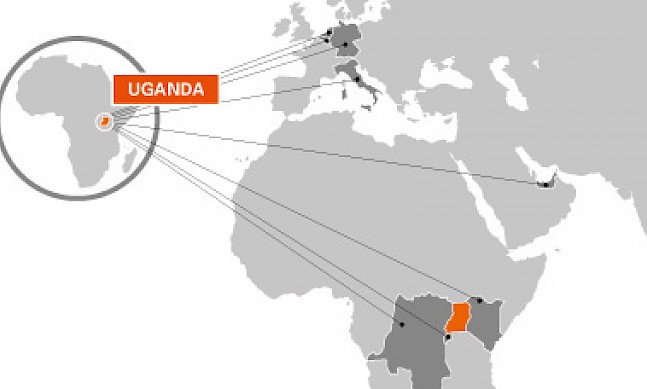

Rakesh Jah: In 2011, we began a project which was about integrating African entities into Africa. Before this, Barclays Bank Uganda’s principal shareholder was Barclays PLC in London, but through this project we made the principal shareholder Barclays Africa Group Ltd, so we are now effectively an African subsidiary. The purpose of this was to integrate all the banks in Africa into one group and drive an integrated strategy across Africa. Therefore, the people who are driving this strategy are well-versed in Africa; they know what Africa is all about, they know the context and therefore they are able to deliver a more localized approach. Our focus is on delivering within the local markets to the local requirements. The good part about the structure is that now we have the flexibility of being a local bank which has a regional presence and a global parent.

“Everyone has an ambition and therefore it’s our job to work with our customers and define their ambition and then help them in the right way.”Tweet This

TRC: How would you appraise the bank’s performance in the country?

RJ: We have made reasonable progress in the financial space, whether it’s number of customers or number of products or balance sheet or income, they’ve all been growing pretty steadily. There are no surprises, there are no big jumps or big drops; we’re growing very stably and that’s what we want.

We have embarked upon a new journey which talks about embracing a set of values for Barclays and that is something that we are very proud of and it helps us to connect with our customers in a very different way. It talks about respect, integrating service, excellence and emotion.

The focus that we have for ourselves is to help people achieve their ambitions in the right way. Everyone has an ambition and therefore it’s our job to work with our customers and define their ambition and then help them in the right way. It is about living in the customers’ world, finding out what we can do together and then putting the actions in place. Our approach is very different. We don’t approach customers with a set menu. Once a week, very informally, we invite one of our customers and their management team for a breakfast. My management team accompanies me and we sit together and we talk for hours. There is no agenda; it’s just about understanding each other. In this way, we get to know our customers’ needs and that creates areas of convergence for us. That is working very well. We’ve done a series of these meetings and they have been very positive. It’s given us a good feel for our customers’ world, it’s given us a good feeling of what we can bring to the table and it’s laid the ground for what we can do for the future.

TRC: What sets Barclays apart in Uganda?

RJ: Our growth story is very different compared to that of others because we have a very wide range of exercises. One of the key things that we want to do is to keep introducing and strengthening the digital agenda, which is the future. We focus on how we ensure that we provide to our customers an opportunity from where they can enhance their quality of life.

We also bring in two or three elements which shape us and make us different. One element is social innovation and that is a very important area, especially in the Ugandan context. In one specific project, we are partnering with some of our partners from the U.S. and in different parts of the world to create a banking opportunity for people who are absolutely marginalized. These are people whose saving capabilities are maybe $2 per week.

We are creating an opportunity for them to bank with us under a special program. It’s about understanding the customers’ world and understanding the strengths they have and then replacing their expensive model with a cheap model for the future. It’s working very well. These are small groups of villagers, and we work with them very closely. We are replacing the traditional way, where they would have community savings in paper accounts, with electronic ledgers which are available on mobile. We are now working very closely with a telecom company to provide us with capability which will enable them to transfer money from mobile money into a bank account that will earn them interest. We are partnering with specialized companies who work with these groups. This is what we call ‘banking for change’ and it’s a very important part of our agenda. We were recognized internationally as the best bank for social innovation.

“If Uganda can capitalize on its human capital then it can be one of the frontrunners in terms of growth and value creation in Africa.”Tweet This

TRC: What is your take on the emergence of mobile money?

RJ: The success of mobile money has been in a few countries only, in limited pockets, and we have to understand why it succeeded and what the future is. In the countries which have large unbanked geographies, large unbanked populations, migration from rural areas to urban areas in search of employment, people doing small jobs, being paid in high frequencies, and then needing to send money back home in small amounts and frequently, this is an ideal setting for the success of mobile money. There was a need and mobile money fitted into that.

However, today the cost of building a small, remote branch is very low and if you can combine the capability of moving money between mobile and bank account, it provides a greater opportunity. Mobile money is just about moving money, but can it earn interest? No. Can users get other banking facilities? No. Digital banking is here to stay and it’s going to change the way people bank.

Another area we are working on is enterprise development, where we combine capabilities of competence and the value chains. What we want to effectively do is try and create opportunities for people in rural areas, and we have a specialized enterprise development team which will help us identify opportunities. One example is looking at ways to connect supermarkets with local farmers, working in a way that they receive the credit they require for them to be able to create a production opportunity and then tie that up with a corporate entity. This could work in so many different ways. That is the future, where people will want more employment opportunities where they are, and that will reverse this rural-urban migration process.

TRC: How do you adapt what is an international banking brand to the particular situation of the country?

RJ: In Uganda, we have a situation where 70 percent of the population is engaged in agriculture but produces only 23 percent of the GDP. There is a mismatch there and that is because people are engaged in very marginal, subsistence farming. The key is to get them to become a bit more commercial, so here in Uganda we have designed a strategy of enterprise development. This country is surrounded by five other countries so there is a big export opportunity. We want to create commercial opportunities to help the country develop. This will also benefit the bank, but it will create social development.

TRC: Where do you want to take the bank in Uganda during your time in the country?

RJ: Logically one would want to be the biggest bank, but one has to be pragmatic. There is a price of being the biggest bank and you don’t want to assume a disproportionate risk. My plan is that in the next three years’ time we should at least be in the top three banks. Slow and steady growth is key, choosing our customers very carefully, choosing our projects carefully and choosing them in a way that the benefits are better distributed in the economy so that there is more equitable distribution of the wealth that we accrete. This is a long-term strategy.

We look at it in the wider context in that technology is going to allow the information flow to happen very seamlessly and rapidly, so the lowest decile of the population is not going to remain out of banking for very long. If we take the first steps then we will be in a far better position to take advantage of this. There is no competition there right now so if I go and make this happen then I will be the biggest beneficiary of this change.

TRC: What would be your message to investors considering Uganda as a destination?

RJ: This is a place where opportunities are waiting to happen. While there is an opportunity in oil and gas, which a lot of people are talking about, the opportunity I see is the demographics, the young, growing population. That is the opportunity. If we can capitalize on that human capital then this country is going to be a very different place in the next ten years’ time. It can be one of the frontrunners in terms of growth and value creation in Africa. People have to have that foresight and vision of what can happen in this place.